Welcome to this Month's FUNDED, also including an overview of funding for the March Quarter 2023.

As predicted in the February edition of FUNDED, March funding levels were quite subdued in part due to the fallout of the recent collapse of the Silicon Valley Bank as well as a number of other factors such the increase in interest rates and cost of living pressures. In March 2023 Australian startups announced they had collectively raised $204m from 36 private rounds. This was less than half the amount announced in February which saw $432m from 47 deals and even down from the usually slow January which saw $372m from 28 deals.

As a Quarter, Q1 2023 saw a little over a billion in private/VC investment with $1.010 billion from 111 deals. Read on for our breakdown of the quarter.

Please share this with someone and ask them to subscribe 🔔

So what happened in the March Q 2023?

We have prepared a bundle of interesting charts and have undertaken analysis of the March Q 2023 in its historical context .. so you don't have to. Click below to access our Canva Presentation. Read on below if you want to know more about the quarter's significant deals.

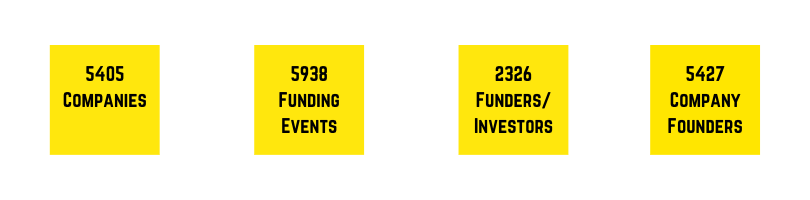

We have published our latest capture to the Techboard platform which is accessible to our commercial subscribers For access to our full data capture, sorted, catalogued and full searchable, inquire about a data subscription.

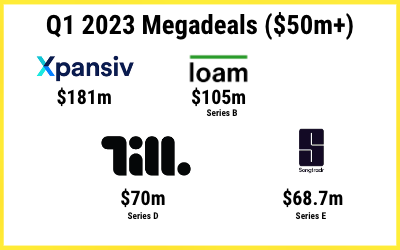

Megadeals ($50m+) in March Q

The March Q 2023 saw four megadeals, which is consistent with the Q1 result in 2021, but well behind the March Q in 2022. Historically the March Q has had comparatively fewer megadeals than other quarters as can be seen in the chart contained in our FUNDED March Q 2023 Funding Update.

Xpansiv Data Systems the marketplace for an ecosystem of environmental commodities, was the only company to announce a $50m+ funding event in January with their $181m coming from Atlas Merchant Capital, Bank of America and Goldman Sachs in the US, Europe’s Vitruvian Partners and Australia’s Aware Super (read more). Xpansiv is now apparently valued at $2b which is the valuation they were chasing early last year when they were planning to go public.

Climatetech Loam and music tech Songtradr both closed Mega Deals in February. Loam Bio, decarbonisation startup, closed a $105m Series B raise. Loam has plans to expand overseas next year. Wollemi Capital and Lowercarbon Capital co-led the round (read more). Songtradr, the data-powered, full-stack, music licensing platform, raised $68m in Series E funding to cover their acquisition of UK-listed 7digital Group. Wisetech founder Richard White invested again, along with existing Australian shareholders (read more).

The only megadeal in March was Till Payments, a fintech startup, which closed a $70m Series D raise (read more).

Deals by Industry Sector

During the March Quarter the leading industry sectors were Climatetech (including Agritech, Cleantech, Clean Energy, Mobility etc), Fintech (including, Insurtech, Regtech, Crypto and Blockchain) and Healthtech/Biotech, which between them attracted 67% of all private funding.

Notes:

- The Entertainment Category was exclusively Musictech startup, Songtradr.

- Food & drink has been partially double-counted, with protein replacement startups being counted in Climatetech.

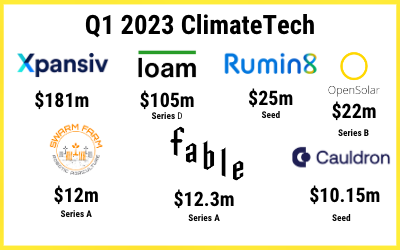

Climatetech Startups, (including select Agritech, Cleantech, Clean Energy, Mobility etc) accounted for $354m or 35% of all funding for the March quarter.

Xpansiv Data Systems kicked off the quarter in January with their $181m raise. Rumin8 , a climate-tech startup, closed a $25m Seed raise (read more...) OpenSolar, a renewables software startup, which closed a $22m Series B raise (read more). Enova Energy, a decentralised energy retailer, that raised $1m from 611 CSF investors via Swarmer (read more) and Vaulta, a battery tech startup, secured $1m from ReNu Energy (read more). Relectrify, an energy storage startup, that secured an undisclosed amount from Toyota Ventures and Creative Ventures (read more).

Loam Bio, decarbonisation startup, led raises in February with its $105m Series B. Alternative meat startup, Fable Food Co closed a $12.3m Series A raise (read more) and SwarmFarm Robotics, an agtech startup, closed a $12m Series A raise (read more). Cleantech startups MGA Thermal, was accepted into Shell's GameChanger Accelerator (read more) and Leakster, secured $185k in Angel funding (read more.) Gridmo, Kapture, and Kelpy, were accepted into Startmate's Summer23 accelerator cohort. (read more) and Solcast, a solar forecasting and data startup, was acquired by DNV for an undisclosed sum. read more.

March saw five Climatetech investments and an acquisition. Fermentation startup Cauldron Molecules, closed a $10.15m Seed round (read more). Canberra-based carbon capture and storage startup MCi Carbon secured a $5m investment (read more.) Sumday, a carbon accounting startup, closed a $2m Pre-Seed round (read more.) Provectus Algae, a biotech startup, secured an undisclosed investment (read more.) Liftango, a transport platform, receives investment from Artesian (read more.) and Lithium battery manufacturer PowerPlus Energy partially acquired by PPK Group (read more.)

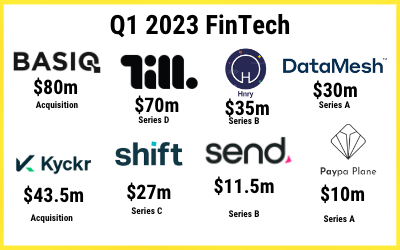

Fintech Companies accounted for $192m in the March Q or 19% of all private investment. The largest fintech investment for the quarter was Till Payments which closed a $70m Series D raise in March (read more).

Other larger fintech raises include Hnry an accounting software startup, which closed a $35m Series B raise (read more), DataMesh Group, a payments software startup, that closed a $30m Series A raise (read more), business lending fintech,Shift, which closed a $27m Series C raise (read more), payments fintech, Send, closed a $11.5m Series B raise (read more) and Paypa Plane closed a $10m Series A raise (read more).

Other fintech funding rounds in the March Q include:

Lumiant which closed a $5.26m funding round (read more).

Alii a school payments fintech, closes a $2.5m Pre-Series A raise (read more).

Collective Shift a crypto content platform, closes a $1.5m raise (read more).

Car insurance startup, koba Insurance which received $1.5 in backing from Ensurance (read more).

Aussie Angels, a platform for investment syndicates, that closed a $1.4m Seed raise (read more).

Invest Inya Farmer, which closed a $1.1m Seed raise (read more).

Blockchain agritech player, Fresh Supply Co. which secured $1.025m strategic investment from Spenda (read more).

NetworksX, an insights platform, that closed a $610k Seed raise (read more).

Bloom Impact Investing, closed a $525k Seed raise. (read more).

Bamboo, a crypto investment platform, signed on Steve Smith as an investor and ambassador (read more).

DASH Technology Group, financial advice platform provider secured an undisclosed investment from CoAct Capital (read more).

Fintech also saw five acquisitions (see the details below).

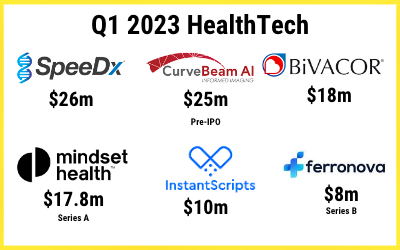

HealthTech companies collectively raised $123m or 12% of private capital in the March Q 2023.

SpeeDx, a medtech startup, closed a $26m funding round (read more.)

CurveBeam AI, a bone fragility imaging tech startup, closed a $25m Pre-IPO raise (read more.)

BiVACOR, an artificial heart maker, secured $18m from OneVentures (read more.)

Mindset Health, a hypnotherapy medtech, closed a $17.8m Series A raise (read more.)

Cauldron Molecules, a fermentation startup, closed a $10.15m Seed round (read more.)

InstantScripts received $10m follow-on investment from Bailador (read more.)

Ferronova, a biotech startup, closed an $8m Series B raise (read more.)

MoreGoodDays, a pain management startup, closed a $3.5m funding round (read more.)

Vedi, a digital animal medical record startup, closed a $3m raise (read more.)

Straand, Scalp-care brand secured a $2m pre-seed raise from Unilever (read more.)

SimConverse, a healthcare simulation startup, closed a $1.5m Seed raise (read more.)

Lenexa Medical, a medtech startup, closed a $1m Seed raise (read more.)

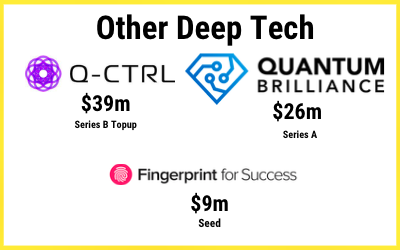

Q-Ctrl Q-Ctrl, a quantum tech startup, closed a $39m Series B top up round. read more.

Quantum Brilliance Quantum Brilliance, a quantum computing startup, closed a $26m Series A raise. read more.

Fingerprint For Success, a generative AI startup, closed a $9m Seed raise. read more.

Cauldron Molecules Cauldron, a fermentation startup, closed a $10.15m Seed round. read more.

The Fintech Funding Project

During 2023 and 2024 Techboard is undertaking a project focussed on fintech funding. We will be aiming to identify and classify all privately owned Australian registered fintech companies and tracking their capital raises to build the most comprehensive picture of capital flows in the fintech ecosystem. We will soon be starting to report on our findings.

This project will produce a valuable dataset available to Techboard's customer and partners and will provide multiple opportunities for exposure on reports and at events.

Please get in touch if you are interested in knowing more or being involved.

Women-Led Ventures

During the March Quarter 2023 women led ventures secured a significantly higher proportion of overall funding than as reported in Techboard's report "Funding for Women Led Ventures" released in September 2022, which revealed that in in FY2022 0.73% of all private funding went to solely women led ventures and 14.9% of funding went to ventures with at least one women founder. The table below reveals that for the March Q 2023, 4.64% of private funding went to companies with an all female founding team and 25% went to teams with at least one women founder. We have not undertaken a complete analysis, which we will be saving for our next "Funding for Women Led Ventures" Report covering FY23, but we would posit that the primary reason for the improvement is most likely a reduction in the numbers of larger funding deals, which tend to be heavily dominated by all male founding teams.

Leading raises for the quarter by solely women-founded startups include SpeeDx, a medtech startup, which closed a $26m funding round (read more), Fingerprint For Success , a generative AI startup, closed a $9m Seed raise (read more) and food tech startup,Morsl, closed a $5m funding round (read more). Pain management startup, MoreGoodDays MoreGoodDays, closed a $3.5m funding round (read more) and Pivot, an edtech startup, closed a $1.4m funding round (read more).

In addition, Kapture, Turnto, and Kelpy were been accepted into Startmate's Summer23 accelerator cohort (read more)and Care Corner, Matilda, and STEM XR were been accepted into Curtin University's 2023 Accelerate program (read more).

Acquisitions

Significant acquisitions in the March quarter include:

Basiq, a data fintech, has been acquired by Cuscal for $80m (read more), Regtech company Kyckr, has been acquired by Richard White for $43.5m (read more) and crypto exchange, Bitcoin.com.au, has been acquired by Independent Reserve for $3m (read more). Wagestream Earnd, the Australian fintech arm of Wagestream, has been acquired by Humanforce for an undisclosed sum (read more) and ZeeFi, a non-bank lender, was acquired by rival Nimble (read more).

Lithium battery manufacturer PowerPlus Energy was partially acquired by PPK Group (read more).

Brandcrush, a martech platform, has been acquired by US-listed Criteo for an undisclosed sum (read more).

Bambody, an underwear eCommerce startup, has been acquired by US based Heyday for an undisclosed sum (read more).

Solcast, a solar forecasting and data startup, has been acquired by DNV for an undisclosed sum (read more).

Voly, the grocery delivery startup, was acquired by Our Cow (read more).

Plezzel, a proptech startup, was acquired by CoreLogic for an undisclosed sum (read more).

IPOS and other Public Raises

Acusensus, an automated camera enforcement startups, listed in the ASX with a $20 IPO (read more).

DroneShield DroneShield, a defence tech startup, completed a $40.3m Post-Listing Raise (read more), MoneyMe, a listed fintech, completed a $37m Post-Listing raise (read more) and Cluey Learning, a listed edtech, completes a $9.56m equity raise (read more).

Other deals (for our paying subscribers)

Details of all deals we capture are available on the Techboard platform for our paying subscribers. Inquire about a data subscription.

Our paying subscribers can login to view the data.

Who Funds the Funders? - Fund News Highlights from Q1

In January the New South Wales Government announced a $40m Biosciences Fund (read more...) and a $7m quantum computing commercialisation fund. (read more...). Tin Alley Ventures, a Melbourne University VC fund, announced it had raised $100m and that it expected to raise $100m more (read more...)

In February there were a few funder fund funding announcements, CVC was raising $200m for their CVC Emerging Companies III fund (read more) and Salus Ventures, a new Australian VC, launched a $40m fund with a focus on defense, robotics, and advanced manufacturing (read more). EVP announced it had closed its fourth fund and raised $100m (read more), Infradebt secured funding from Grok Ventures (and others) for its Energy Transition Fund (read more), Startmate secured funding from Tattarang (read more), Tanarra Capital established a new $100m fund (read more), and View Media Group, a proptech investor, secured $50m from ANZ (read more). LaunchVic received $1.3m from the Victorian Government for agtech startups (read more), and three WA VCs will each receive $100k for the next three years from the WA Government through its WA Venture Support program (WAVES) (read more). OIO's 2023 Ocean Impact Accelerator is accepting 10 startups and awarding them $100k each (read more).

In March the National Reconstruction Fund (NRF Fund) passed the Senate enabling the NRF to be established. The NRF includes an at least $1 billion commitment to invest in critical technologies, as a priority investment area within the broader $15 billion NRF. Co Ventures, a new 'friends and family' Pre-Seed fund, raises $5m. read more. LaunchVic announced it was allocating $300k for organisations to run pre-accelerator programs for women (read more.) M8 Ventures announced it was raising $10m for a new fund. read more. The Medical Research Future Fund (MRFF) announced it had created a new $50m medtech incubator. read more and Radar Ventures announced it had launched a deep tech investment fund. read more.