Techboard is pleased to announce that on the not so long lead up til the end of another tax year we have partnered with BDO to bring the Techboard audience increased guidance on the application of the Innovation Tax Incentive.

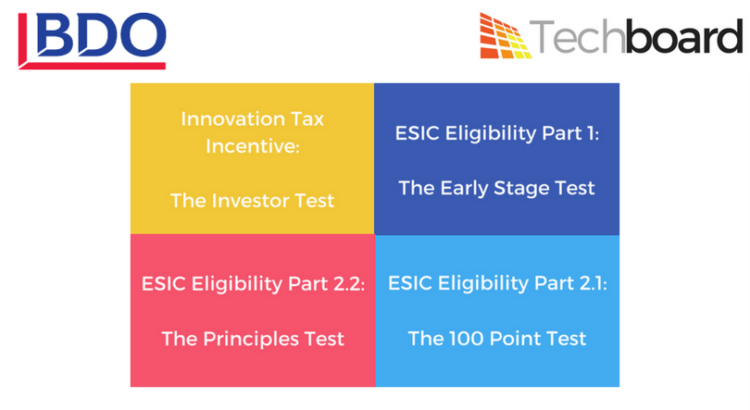

BDO have developed a number of documents to help Australian startups, tech companies and investors to self assess for the Innovation Tax Incentive. For an investor they will assist to determine if an investment they have made or are planning to make will entitle them to tax relief and for a company the forms will help them to judge whether they are eligible as a Early Stage Innovation Company which can arm them for discussions with potential investors.

Marc Loftus, Tax Partner at BDO Perth said:

“BDO is committed to supporting our home grown innovation community and assisting young companies and early stage investors to navigate the early stage innovation company tax incentives is just one way that we are assisting the Australian Start-up community.”

Techboard have taken BDO's documents and developed a series of online self-assessment forms for prospective investors and Startups. Peter van Bruchem, Co-founder of Techboard said:

"The Innovation Tax incentive can make a significant contribution to the funding of Australian Startups and we are happy to help our community of startups, young technology companies and investors to better understand how they can take advantage of the innovation Tax incentive.

To find out more about BDO and how they can assist please refer to BDO's problem solver profile on Techboard or contact BDO.