This report is the sixth quarterly funding report published by Techboard and the fifth with multi-state coverage. Techboard will be publishing its first annual funding report for the 2017/18 financial year later this year. That report will include a full overview of the year in Startup and Tech funding in Australia, including all funding events in the reports published for the year to date and any others that are discovered as well as detailed analysis.

We have released a new infographic illustrating trends in this report.

We are actively seeking data partners and sponsors so contact us to get your logo on our next report.

by Peter van Bruchem

Press Coverage of the Report

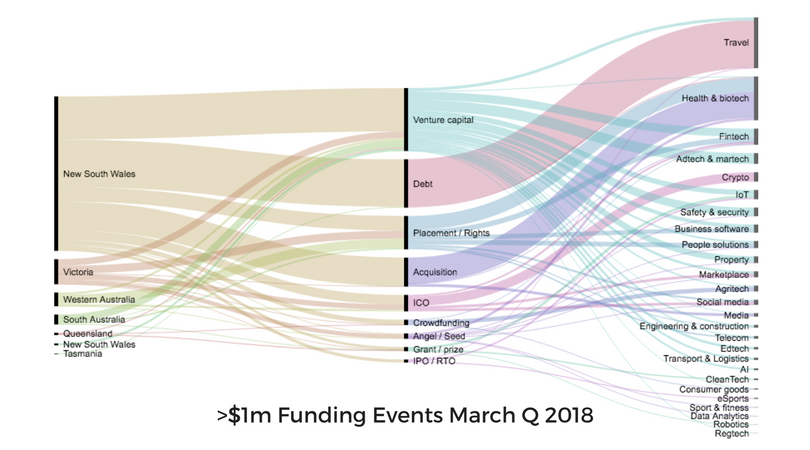

National Funding Overview

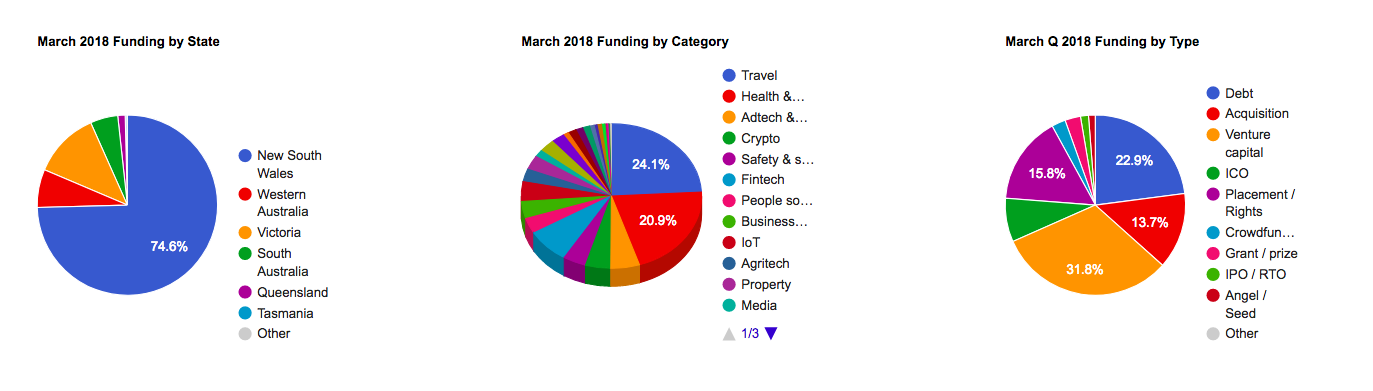

For the last March quarter 2018, Techboard captured the highest level of funding of any of its quarterly reports to date, having identified 142 funding events ranging in value from $5,000 to $220m, totalling a massive $952m. The growth in funding from the previous quarter of $720m was led by a 50% increase in Venture Capital (or series A, B, C etc) funding as well as some major individual funding events. New South Wales companies contributed most to the increase, but other states like South Australia also experienced significant increases in funding levels.

Highlights for the March quarter:

142 funding events recorded from all sources with funding levels nearing $1B ($952m) for the March quarter 2018.

Largest individual funding event – Splend $220m debt funding.

Largest VC investment – Canva $50m round led by Sequoia China,with Blackbird Ventures and Felicitis Ventures, giving the company a US$1b valuation and unicorn status.

Largest Acquisition – Elastagen acquired by Allergan, the maker of Botox for $120m.

Largest ICO – Havven $39m.

Largest Crowdfunding – Flowhive raised over $19m AUD on Indiegogo.

The biggest sectors were Travel (thanks to the massive debt deal for Splend, which does vehicle rentals for uber drivers) and Health/Biotech with the Fintech sector coming in third, with a reasonable drop in new funding from the previous period.

Female founded companies that received funding during the March quarter included, Canva ($50m), Agri-digital ($5.5m), Aurora Labs ($5m), Honee ($1.8m), Intimate ($4.5m), Xinja ($2.4m), Tap into Safety ($750k), Revvies ($300k), Like a Photon ($257k) and the Volte ($150k).

[wpdatachart id=13]

Changes from our report for the December Quarter 2017

Techboard recorded a 50% jump in VC/large scale private investment, going from $200m to over $310m with the number of investments captured up from 28 to 46.

The use of initial coin offerings as a funding mechanism continued with five ICOs raising over $76m, including the biggest yet for an Australian company – Havven at $39m. This represents a similar level to what Techboard reported in the December quarter (with five ICOs raising over $73m).

Public (ASX) capital raisings were down with 15 public raisings, including 3 new listings (IPO/RTO), raising $148m, compared with 20 raisings including 3 IPOs for the December quarter ($224m).

Debt (including venture debt) was up from $180m between 3 companies to over to $224m to two companies.

Grants/awards were up from $20m to $27m.

Angel/seed was down from $21m to $11.8m.

Crowdfunding experienced a big jump from $0.5m (1 crowdfunding event recorded) to over $24m with 5 crowdfundings, including 2 equity crowdfundings (Xinja on equitise and Revvies on onMarket), and one of, if not the largest, crowdfunding events for an Australian company with Flowhive raising over $19m on Indiegogo.

Acquisitions were up from 6 to 7, including the acquisition of Elastagen for $120m, although a comparison between periods is difficult with acquisition values often being undisclosed.

Reductions in funding levels were experienced in many states but this was more than offset by the increases mainly in NSW.

The States

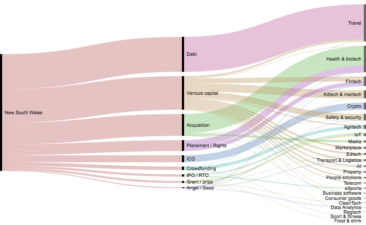

New South Wales

New South Wales was clearly the leading state with almost three quarters of national funding totalling $728m, representing an increase of 50% over the December quarter. New South Wales had the largest individual funding event for the quarter (Splend), the largest acquisition (Elastagen), biggest VC investment (Canva), largest ICO (Havven), largest public raise (Lendi), largest IPO/RTO (Simble) and largest crowdfunding (Flowhive) and first and largest equity crowdfunding (Xinja).

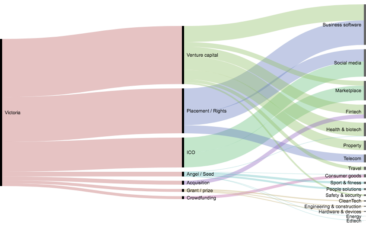

Victoria

Funding levels in Victoria dropped from $234m for the December quarter to just under $113m, with the biggest individual funding event being a public raise by software company LiveTiles for $20m. Similarly to New South Wales, the primary source of funding for Victorian startups was venture capital with 9 deals totalling over $47m, including $13m to Software company Whispir, $8m to Airwallex and $7m to Biotech Cincera Therapeutics. Initial Coin Offerings for Canya and Shping raised $12m and $8.6m respectively.

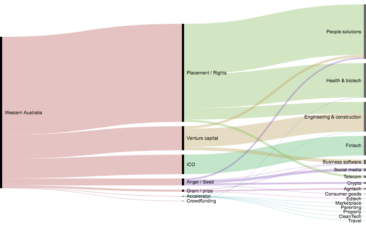

Western Australia

Western Australia experienced a significant drop in funding from almost $106m to just under $47m. Notably, funding coming into startups and tech companies via the ASX fell from $81m to $23m. Last quarter’s result in WA also included the funding of Power Ledger to the tune of $17M via Initial Coin offering (ICO) (the company’s pre-sale token generation event was reported in the September quarter). As usual in WA, the ASX played a significant role in funding with public raises accounting for over 49% of funding. The largest funding event was a $15m placement into Botanix. This quarter also saw an ICO for Bitcar which raised $8.6m.

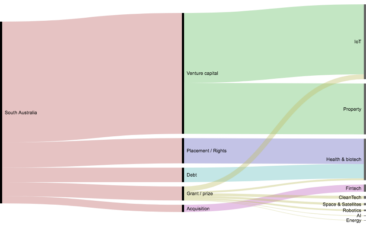

South Australia

South Australia saw a seven fold increase in funding from the previous quarter jumping from under $7m to over $48m, with two major venture capital investments into Myriota $19.4m and the Happy Co. for $14.1m. As with Queensland, grants played a major role in South Australia with grants totalling close to $4m.

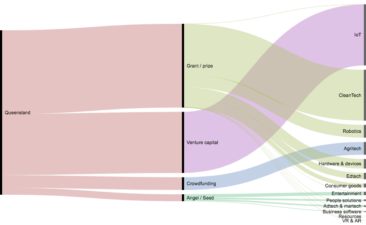

Queensland

Queensland was yet another state that saw a drop in funding from over $18m to just under $13m. Making up a large proportion of the funding for March was a significant venture capital investment of $4.8m in Movus. One notable feature of startup funding in Queensland this quarter was the prominence of Grant/prize funding (over $6.5m).

Investors

Significant private investments which are recorded in this report were made by:

- recognised Australian Venture Capital funds make significant investments including Airtree, Blackbird, Right Click, Main Sequence, Artesian, Our Innovation Fund, Blue Sky Ventures, Reinventure, Medical Research Commercialisation Fund, OneVentures and Square Peg Capital Microequities Venture Capital.

- Foreign investors such as Sequoia China, Triangle Peak Partners (US), MDI Ventures (Indonesia), Dayang Group (China), Singtel Innov 8 (Singapore), BoardRoom (Singapore) HorizonX Ventures (US) Element Fleet Management (Canada).

- Venture groups individuals and family offices including Alium, Investible, Jolimont; Viburnum, Roger Allen, Steve Baxter, Grok Ventures (Mike Cannon-Brookes) Dean McEvoy, Tim Fung, Alan Jones, Larsen Ventures, Richard, Mergler, Steve Tucker, Matthew Heine, Dorado Capital, Allectus Capital, Challenger Limited, High Line Alternative Investments.

- Superfunds such as First State Super and HostPlus.

- Corporates including Seek, Westpac, NAB, ANZ, RACV, Southern Cross Austereo, QANTAS, Caltex, Telstra Ventures and KPMG.

- Angel Groups such as Brisbane Angels, Perth Angels, Sydney Angels, Brisbane Angels, Melbourne Angels, Gold Coast Angels.

Further Analysis of Investors will be provided in our first Annual Report for the 2017/18 Financial year.

Notes on Report:

- All dollar values are in Australian Dollars unless stated otherwise.

- In terms of distinguishing between Angel/Seed and Venture Capital investments Techboard tends to follow the description of an investment round used by the company.

- ICOs are reported at AUD$ equivalent reported at time of closing.

- Some investments recorded as VC may be lower in value than some Angel/seed investments

- Some investments made by Australian VCs may be recorded as Angel/seed

- Investments categorised as Venture Capital include investments made by a range of investors including recognised venture capital funds as well as a wide range of investment groups, family offices and others from within and outside Australia.

- For the purposes of this report companies are categorised in one category and one State, whereas companies may validly sit in multiple categories and have significant presences in several states.

- Investments that are recorded as having a zero value – were publicised investments for undisclosed amounts.