Welcome to the first edition of FUNDED for 2022, our seventh edition to date.

This FUNDED covers the biggest January Techboard has ever captured and also provides a taster of our 2021 Funding Bulletin. Techboard does its major report covering the previous financial year so this Funding Bulletin is really a brief update for the balance of the 2021 calendar year.

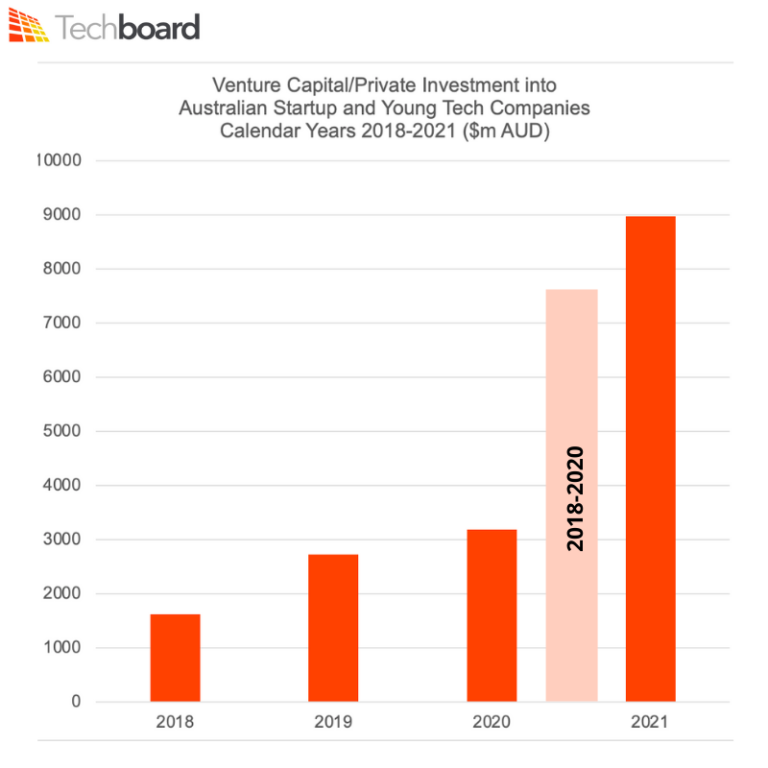

Our top end analysis of 2021 will come as little surprise to regular readers… Venture Capital and Private investment levels in 2021 started strongly then went through the roof to the extent that the private funding for the calendar year 2021 exceeded what Techboard captured for the entire previous three years, $9b to $7.5b.

NEW to FUNDED… Deal Notes

This FUNDED features deal notes from Airtree, Blackbird, Squarepeg, Investible, EVP and Afterwork Ventures. Links to these and other deal notes will be added to the growing Techboard platform.

Airtree: Building the crypto derivatives platform of tomorrow – Our investment in Zeta

Squarepeg: Saasguru AUD$1.3m pre-seed

Afterwork Ventures: SwingVision — real-time, automated video analysis for tennis

EVP: Investment Notes: Explorate

Blackbird: Investment Notes: Bardee

Investible: Investment notes: Shipeezi

Contact us if you would like your firm’s deal notes included.

So what happened in January 2022?

Who’s been FUNDED?

January 2022 was a comparatively big capital raising month with over $600m in VC/private investments (or over $1b if you count an investment into Cyara ...see below. Sure $600m isn't big compared to $1.8b in September 2021 or $1.19b in December 2021, but we have only record 6 months with startups raising more... and it is the biggest January we have see by a factor of more than four.

The pandemic would seem to have made quite an impact on several deals last month, with four Australian food delivery and subscription companies getting funded, listing or acquired featured in January. Food delivery startup Milkrun led the pack closing a $75m series A after an $11m seed raise last year. Melbourne based food delivery business Easi was acquired by London based HungryPanda for $50m and Food subscription startup My Foodie Box lists on the ASX and raises $6m. We are also aware of another Food Delivery startup that is raising a Series A after a $3.1m raise just last year.

The month’s megadeals (>$50m)

- We normally wouldn’t feature this raise as the company is quite old, founded in 2006 but given the raise is so big… Cyara a provider of customer experience solutions secured growth investment of $490m ($350m USD). The investment came from K1 Investment Management out of New York. Back in November K1 made another $350m USD investment in an even older (2002) Brisbane based (former) startup Leading Global Provider of Field Service Management Software, simPRO.

- Online health startup Eucalyptus completes a $60m series C raise.

- Proptech startup HappyCo raises $72.4m.

- Cranky Health is valued at $200m after receiving investment from Pacific Equity Partners and face of Man Shakes, Adam MacDougall. The size of the investment wasn’t disclosed but was likely to be north of $50m.

An almost Unicorn?

- Customer Research startup Dovetail raises $89m for a $960m valuation.

IPOs

Adding to My Foodie Box IPO we have Nasal spray startup Firebrick Pharma which raised $7m and Beforepay which raised $35m.

Acquisitions

- Telstra acquired IoT startups Aqura Tecnologies and Alliance Automation.

- Food delivery blockchain startup Rewalty was acquired by iSynergy for around $800k.

- NAB bought LanternPay.

- Uber nabbed Car Next Door for $50m.

- Mining technology startup Minnovare acquired by Hexagon AB.

Other Funding Events (VC/Private, Public(ASX), ECF, Debt, Grants/Awards)

(This is just a sample of the deals we captured in January - Commercial Subscribers get the full list + full searchable access to all funding data captured by Techboard since 30 July 2017).

Fintech was again prominent with Plenti securing a $250m warehouse facility with Westpac and Grow Finance closing a $35m raise and securing a $450m debt facility.

- Tiger Global made yet another Australian Investment, this time in TradeSquare who raised $28m, adding to their five investments we picked up for 2021, which included their $210m investment into Scalapay.

- Sportstech startup Lumin Group backed by ex-AFL players raises $1.15m.

- Female founded iNSPIRETEK has raised $2.5m in a seed round.

- Edtech startup saasguru has successfully raised $1.3m in seed funding.

- Digital freight forwarding startup Explorate closed a $7.5m seed raise.

December FUNDED revisited

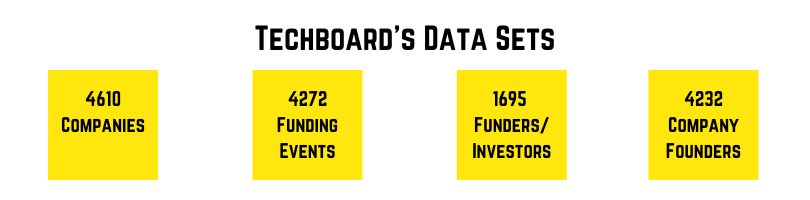

In the last edition of FUNDED we reported 66 funding events in our preliminary review, which after further research and review we lifted that number to to 69 funding events including 48 private investments, which raised a total of $1187m. Those funding events have been added to the Techboard database, along with new company, investor and founder profiles, bringing Techboard’s tallies to the end of December to 4272 funding events, 4610 Companies, 1695 funders and investors and 4232 company founders.

Find out more about FUNDED. While the list below is lengthy it is far from the complete list of what we capture. For access to our full data capture, sorted, catalogued and full searchable, inquire about a data subscription.

Other funding events for our paid subscribers: Our paid subscribers get access to the full list containing another 12 funding events.

News from Funders

- Squarepeg details its $550m raise.

- Geminio Fund is raising $50m to invest in the metaverse.

- Palisade Impact is creating a $250m fund.

- Future Now is looking for $150m from investors.

- Perth Angels commence 2022 funding.

And a bonus announcement so big we aren’t waiting til we do February’s FUNDED…..Airtree announces $700m in new funds, a $200m Seed fund, a $50 million fund for DeFi, NFTs and DAO projects and a $450 million growth fund.

Who’s Looking for Funding?

- Infant formula and milk startup Nature One Dairy is seeking to raise $20m in an IPO.

- Blockchain commodities startup Bullion Asset Management is seeking a $5.5m series B.

- EV infrastructure startup Bell Resources is seeking to raise $190m.

- Fintech Cohort Go wants to be bought out.

- This Food Delivery startup is raising a Series A after a $3.1m raise just last year.