We are pleased to publish our latest report: "Tracking Unannounced Investments: Building towards revealing the true scale of investments into Australia’s Growing Startup and Technology Company Ecosystem: 2018 to end August 2025".

This Report outlines the work Techboard has been doing to build the most comprehensive data service on Investment and investors in Australia’s startup, scaleup and technology companies. This will provide massively enhanced data on investment and investors in Australia's growing Startup and Tech Ecosystem, greatly in excess of what is currently available from any other provider of startup investment data.

This expanded data service can be particularly useful for Governments, Industry groups, service providers, investors and founders.

The approach Techboard is working to roll out derives from the approach piloted in the Fintech Funding Project undertaken by Techboard in 2023, culminating with the 2024 publication of The Fintech Funding Project 2023 REPORT: Shedding light on Investment into Australian Fintechs.

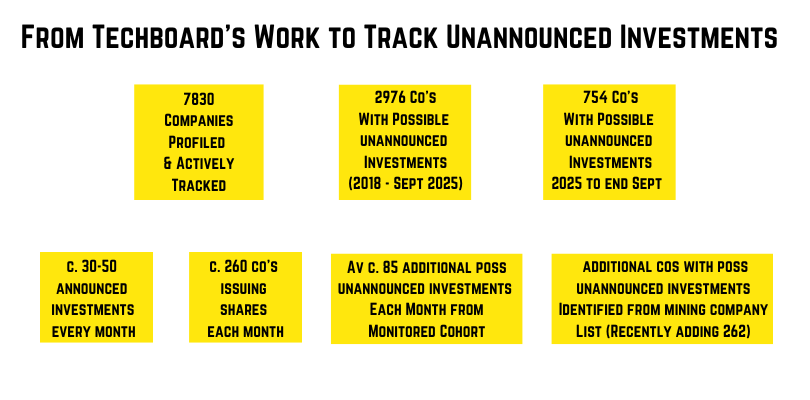

The trigger for producing the report is that Techboard has now implemented a solution to automatically track Australian companies' ASIC lodgements so we can discover when any of the 7500+ companies we are tracking issue shares as an indicator that they may have raised capital/secured investment.

The work underlying the preparation of this report represents the step before purchasing bulk company data from ASIC, as we did in the Fintech sector.

Now while the work of compiling the cohorts of companies in order to track their lodgement activities is not our end game, we realised that the share issuance data we have been compiling can provide some probative value of its own even prior to the purchase of additional ASIC data to confirm unannounced investments, the size of each investment, the valuation and details of unannounced investors.

Techboard’s work on rolling out our new data approach is showing evidence of significant levels of possible unannounced investments being made into Australian Startups and Tech Companies, with roughly as many companies showing possible unannounced investments as have announced investments over the past eight years.

Of the 2950 companies which may have had unannounced investments just over 1000 have previously announced investments in the years prior to the latest share issues we have identified. This means that we have identified close to 2000 companies from a cohort of over 7500 that show signs of possibly having raised capital but have not announced this (or in some cases, Techboard has not captured).

To further put the scale of these numbers into context, over the past eight years we have captured between 400 and 800 announced investments per year.

When we look at 2025, (to the end of August) we can see more than double the number of companies appear to have possible unannounced deals (682) when compared to the number that announced (255). We also saw that over half of the companies with possible unannounced investments had previously announced having received investment.

The online report is published on Canva and contains many interactive charts using the Flourish platform which was acquired by Canva. While the report can be viewed on mobile, the best viewing experience will be on a larger screen.

The Review can also be downloaded in PDF form without the interactive charts below:

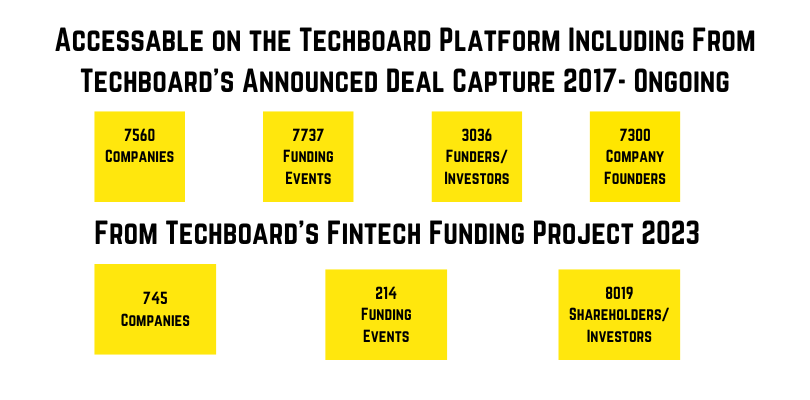

Techboard's Datasets

For access to our full data capture, sorted, catalogued and full searchable, inquire about a data subscription.

Details of all deals we capture are available on the Techboard platform for our paying subscribers. Inquire about a data subscription.