Techboard is pleased to present The Fintech Funding Project 2023 REPORT: Shedding light on Investment into Australian Fintechs based upon regulatory Data from the Australian Securities and Investments Commission in combination with Techboard’s Industry leading announced deal data.

Techboard would like to acknowledge the support of our funding partners LaunchVic, and the City of Sydney for their generous contributions towards the costs of preparing this report. We would also like to acknowledge Fintech Australia for generous access to their ecosystem data which we used to assist in assembling the initial company dataset that would be the focus of this project and for their generous contribution to the ongoing costs of monitoring Australian Fintechs' ASIC lodgements which is enabling Techboard to produce a supplement to this report with data from H1 2024.

Prior to commencing this project Techboard estimated that in the order of 50% of capital raises went unannounced. We know that funding data is an important indicator of firm activity and growth and market intelligence. So it followed that many decisions by policy makers, investors and others were being made on the basis of less than perfect and not necessarily representative data.

Whenever a company issues shares it must lodge with the Australian Securities and Investments Commission (ASIC). All data lodged with ASIC is non-confidential and publicly available if you know where and when to look (and pay for access to the data). So we knew that there was a vast reserve of valuable information that could be mined to reveal greater insights than could be gleaned just from companies’ announcements. We worked out a way to add this valuable data source to Techboard’s data acquisition to add value to its customers and attract more new customers to its offering.

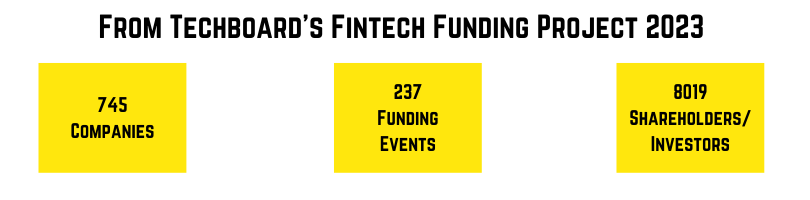

The Purpose of the Fintech Funding Project and this Report was to test Techboard’s unique methodology for gaining clearer insights into capital raising activity in Australia on one of the most significant industry verticals in the overall Australian startup ecosystem.

In the report we:

- investigate the extent to which investments into Australia’s Startups goes unannounced;

- identify which companies are raising capital but not announcing this;

- Investigate who is funding Fintech Startups in Australia; and

- illustrate the sort of insights that can be gleaned from considering non-confidential ASIC-sourced company data as well as announced deal data.

What we found was quite enlightening.

The first part of the report addresses Unannounced Capital Raising Activity. We found that for 2023:

- a large proportion of startup investment in Australia goes unannounced, More than 50% of capital raises went unannounced... in fact the announced deals accounted for only 37% of likely capital raises we identified in this project (by number of deals).

- 143 fintechs with unannounced raises collectively totalling just under $684m, supplementing the 83 announced deals raising $769m in announced deals that Techboard captured for 2023, taking the total raised by Australian Fintechs in 2023 to a total of $1,453.21m for the 2023 calendar year.

- The unannounced investments ranged in size from c$50k to over $50m, from pre-seed to late Series C+ stage with the most common size being between $1m and $5m (46 deals).

- The large majority (73%) of unannounced deals were between $100k and $5m in amount.

- Calculated company valuations from unannounced capital raises ranged up to over $1b, with 11 companies with $100m+ valuations and one with a valuation over $1b.

- When viewed through a gender lens we saw that solely women-founded companies had significantly more unannounced deals (by dollar value) than the almost negligible dollar amount of announced deals for the year but that the level of investment in 2023 was still behind the proportion of fintechs with women founders. We did however find that things weren’t all bad for women-founded fintechs with strong average deal values and levels of investor capital which were in line with the proportion of fintechs founded by women.

- The larger states New South Wales and Victoria, had a higher proportion of total investments by dollar amount coming from announced deals, whereas the smaller states other than the Australian Capital Territory had a higher proportion of total investments in dollar value coming from unannounced deals. All states other than ACT had more unannounced deals by number than announced.

Part 2 of the report investigating the capitalisation/shareholding of companies went on to reveal:

- The leading category of investors by capitalisation were non-institutional investors which accounted for roughly 35% of all investment capital in Australian Private (Pty Ltd) Fintechs, ahead of Corporate at 31% and Venture Capital (including Foreign VC) at 23%. Australian Venture Capital accounted for just over half of all VC (51%) or 11.7% of investment capital. (On this point it is noted that certain limits exist on VCs investing in some types of fintechs under the statutory rules on Venture Capital Limited Partnerships and Early Stage Venture Capital Limited Partnerships).

- Non-institutional investors play an even bigger role in earlier stage investment as high as 60% of all Australian investment capital for companies with $1-$5m of investment capital.

- Foreign investors directly own 17.6% of issued capital in Pty Ltd Fintechs and contribute an estimated 21.5% of investment capital with their share of capital increasing as the companies capitalisation levels increase. We were not able to determine the level of Direct Foreign Ownership in Public (Limited) fintech companies. We are also unable to see the level of foreign investment via Australian registered investment vehicles or fund structures, including Australian venture capital.

- The largest amount of foreign capital comes from the United States ($346m), followed by Singapore $112m, the United Kingdom $97m and New Zealand at $70m.

- A surprising amount of investment came from recognised tax haven countries. Considered collectively they would be the second biggest foreign contributor of investment capital ($132m) behind the USA.

- The use of convertible notes was highlighted, including in large megadeals (>$50m).

- The use of different corporate structures varied from state to state, specifically when considering Private (Pty Ltd) vs Public Companies (Ltd) we saw that two states, Western Australia and Queensland had very high proportions of company capitalisation in Public Companies. This impacted on the amount of data available for analysis as the investors and their shareholdings are only readily accessible for Private (Pty Ltd companies).

The online report is published on Canva and contains many interactive charts using the Flourish platform which was acquired by Canva. While the report can be viewed on mobile, the best viewing experience will be on a larger screen.

You can also download the Review in PDF form without the interactive charts below:

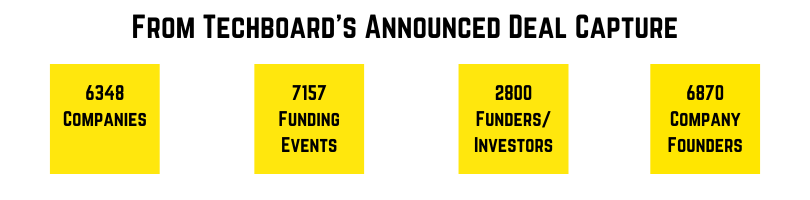

Techboard's Datasets

For access to our full data capture, sorted, catalogued and full searchable, inquire about a data subscription.

Details of all deals we capture are available on the Techboard platform for our paying subscribers. Inquire about a data subscription.