In order to provide greater insight into how the funding environment is evolving in the light of COVID 19 Techboard has started looking at funding data on a monthly basis. This release provides commentary on the first four months of funding data for 2020. More information on funding in the month of April is available in our first Monthly Funding Bulletin. The Funding Report for the March Quarter 2020 is available below.

In the March quarter 2020 Australian startups and young technology companies secured $1.75 billion in funding from 170 events. This was one of the strongest quarters overall we have seen since the March Quarter 2019 at $2.739m (which included the PEXA acquisition at $1.6b). Techboard started collecting national funding data in 2017).

The March quarter was dominated by several very large funding events from Neobanks and fintech lenders (Xinja, Judo, Get Capital, Society One and Volt Bank), representing 63% of all funding for the Quarter. The March quarter was the biggest quarter for private investment Techboard has reported, with $1.2b captured. A very large proportion of the private funding was for fintech (70.4%), and in particular neo banks with the top 3 private investments for Xinja, Judo Bank and Volt Bank totalling $903m of the $962m raised by fintech companies. The only other funding type to show growth from the 2019 averages were Grants and Awards, which were up 31% to $7.8m. All other funding types saw declines in the March Quarter from the average level in 2019, with the most notable drops in public funding with both IPOs and Post-Listing raises seeing a reduction of over 40%.

April funding was higher than the average for the March Q at a touch over $1b, making it the highest level of monthly funding captured (excluding acquisitions). This increase over previous periods came surprisingly as a result of Covid 19, with the Commonwealth Government allocating Judo Bank with $500m of investment funding to help Judo loan money to small businesses impacted by Covid 19. This latest investment for Judo takes the total amount it has raised since September 2018 to over $1.4b. Private funding in April set a monthly record at $890m but this was dominated by Judo Bank and Airwallex with a massive $254m raise. Similar to the March Q, most other funding types were down for the month, with Placements continuing their slide although IPOs were up from the 2019 monthly average thanks to the $30m IPO by Atomo Diagnostics.

Looking purely on the top level numbers, Techboard funding data for the first four quarters of 2020 would appear to tell a very positive story, with several funding records being set, both for individual companies and overall monthly and quarterly funding levels (at least when you look at private investment). However if you break down the data and consider different funding types and activity at different deal sizes, a less rosy picture starts to emerge. This is unfortunately reinforced by talk of many companies’ planned capital raises not going ahead. While we can take some positives from the data, it could have been much better news had we not been hit with corona virus.

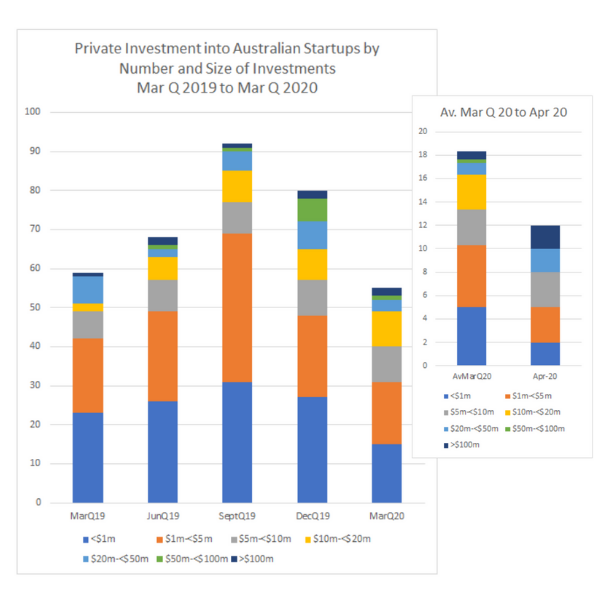

What we are seeing from the March quarter and flowing into April is a reduction in the number of published deals, a reduction in the overall amount of private funding from and number sub $100m investments and a reduction in the number of sub $100m large scale investments.

Instead of the upwards trend captured for 2019, we have seen what looks to be a downward trend in Private investment starting in the March quarter 2020 continuing downwards into April with a steady decline in sub $1m, $1m-$5m deal sizes. April recorded no investments in $10-$20m or $50-100m ranges. The level of investments in the $5-$10m range stayed steady from March to April while $20-$50m and >$100m deal investments increased. We have also seen reductions in other funding types.

The March quarter 2020 is explored in more detail in the March Q 2020 Funding report and April’s data is further explored in the April Funding Bulletin. A further release on May data will be available shortly. More detailed analysis will be available when Techboard publishes its report for the 2019/20 Financial Year.

WE NEED YOUR HELP

Techboard collects this funding data in three ways, via algorithmic collection, manual research and direct reports received from companies and investors. While Techboard endeavours to be as comprehensive as possible in its collection activities there will be published funding events that we miss.

Our Data helps to fuel the growth of the Startup and Tech Ecosystem in Australia, informs the work of groups like StartupAus as well as governments around the country. Our data is also available to investors.

Please report your funding events to us to help our data be as comprehensive as possible.