Download the full map and report here: PERTH 2.0 – Joining The Dots.

Introduction

This mapping exercise is the first in Techboard’s Perth 2.0: After the Boom series, through which we hope to offer a variety of perspectives into Perth’s nascent startup and technology company ecosystem.

The startup and technology sector has the potential to drive future economic growth in this state, and as such is deserving of our attention. In this first map we focus on the inter-connectedness of the ecosystem.

Please get in touch with any comments or feedback on this map, or if you are interested in collaborating on future reports.

The companies

The scope of this report extends to startups and technology companies which are based in Perth, or have a significant relationship with the city. This can be at times more a question of opinion that data. We are of course very proud of our state, but occasionally the desire to associate success stories (like Canva) to our city has to be tempered by the fact that, on the balance of evidence, the company cannot be described as West Australian. More information on the inclusion criteria can be found on Techboard’s website under Listing Rules.

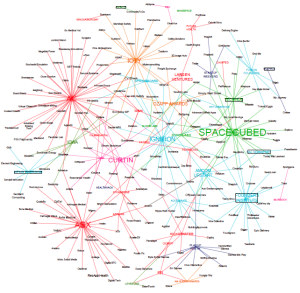

The displayed size of individual company nodes is proportionate to their Techboard score over a ten week period from September to November 2015. This provides a snapshot perspective of companies which have been trending over that period.

The hubs

Hubs have been split into the following categories:

Accelerators (9): Amcom Upstart, Curtin Accelerate, Curtin Ignition, Founders Institute, Fusion Founders, KPMG Energise, RAC Speedspark, RIIT Unearthed and Springboard.

Awards (3): Innovator of the Year, OzApp Awards and WA Screen Awards.

Co-working spaces (6): Bloom Labs, Minespace, Sixty27, Spacecubed, Sync Labs and Tech Hub.

Events (4): GovHack, HealthHack, Playup Perth and Startup Weekend.

Incubators (2): Innovation Centre of WA (ICWA) and Level One.

Sources of funding (14): Accelerating Commercialisation (AC), AppLabs, ASX, Chuffed, Fat Hen, Future Health, Indiegogo, Innovation Bay, Kickstarter, Larsen Ventures, OOMPF, Stone Ridge Ventures, Western Australian Angel Investors (WAAI) and Yuuwa Capital.

Universities (4): Curtin University, Edith Cowan University (ECU), Murdoch University and University of Western Australia (UWA).

The displayed size of the hub nodes are proportionate to the sum of the Techboard scores of the companies attached to the node. Therefore the greater the number of companies related to a hub, and the greater their cumulative scores, the greater the hub node will appear on the map.

The connections

The data has been compiled from online research and interviews, and from the Techboard database. Where hubs have declined to be involved in our survey, we have collated publicly-available data with our own research, but at the risk of under-representing the connectedness of that hub.

Connectedness

We have identified the three most ‘connected’ startups and technology companies in Perth, and they are all software companies, and none of them target the resources sector. Offpeak Games (indie games developer), oneVR (virtual/augmented reality software developers) and iCetana (video surveillance intelligence software) are each connected to five hubs, and in the case of Offpeak, a sixth one to come with the launch of its Kickstarter campaign later this month.

All three companies have a link with Curtin University, with Offpeak Games and oneVR having been through the university’s Ignition program, and iCetana being a Curtin spin-out. Two of them are based at Spacecubed, and two of them have successfully raised funding through angel investors (WAAI) or venture capital (Yuuwa Capital).

There are a further eight companies with four connections: Bombora Wave Power, Circadyn, ePAT, GeoMoby, Newton Labs, SEQTA, Skrydata and Tap Into Safety. Three quarters of these companies again have links to Curtin University, either as spin outs or through the Ignition program.

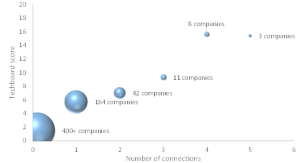

There is a strong though unsurprising correlation between the number of connections and the average Techboard score, validating that companies which have multiple touch points with the community are more likely to generate interest and engagement (‘get noticed’) than those with fewer. Obviously this is only a rough analysis, as not all connections are equal: any startup can pay a few hundred dollars to join a co-working space, but not all startups can win an Innovator of the Year award or be accepted into a competitive entry accelerator.

A note on sources of finance

As is the case in most cities, entrepreneurs frequently despair about the lack of funding for startups and technology companies in WA. In this map we have adopted a more positive perspective and tried to illustrate the diversity of sources of early stage funding.

While we have mapped the better known sources of angel investment (WAAI, Innovation Bay, Future Health, Larsen Ventures) and venture capital (Yuuwa Capital, closed to new investments), this provides just a glimpse into what is available out there. There are many other active investors who remain out of the public eye, as reported on in Boundlss’s 2013 Startup Ecosystem report.

AusIndustry’s Accelerating Commercialisation program is one of the main sources of funding to Australian startups, and as such plays a big part in supporting Perth’s early stage companies. While we have classified it in the Funding category, AC’s offering extends beyond just the matched-funding grants and includes commercialisation guidance and support.

While some of these sources are not WA-based, they remain open and very relevant to our ecosystem. Rewards-based crowd-funding platforms like Kickstarter, Indiegogo or Chuffed are particularly useful for product launches and the games sector, as demonstrated by Cycliq which has raised close to $1 million (essentially in pre-sales) across two campaigns to fund its cycling camera/light combo.

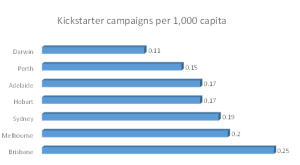

Looking at statistics on Kickstarter which is the biggest platform globally and in Australia, it’s clear Perth startups are not taking full advantage of available crowd-funding opportunities, ranking only second last on a per capita basis.

Equity crowd-funding hasn’t really developed in Australia yet and as such does not appear on our map. Rule changes allowing retail investors to participate in crowd-funding are widely expected in the new year, and there are a number of platforms poised to leverage these changes as soon as they are implemented.

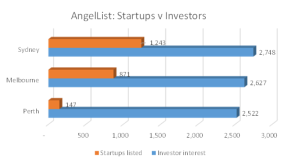

US hub AngelList has been a trail-blazer in this space, allowing startups to raise equity funding online from remote accredited investors. At time of writing Perth only has 147 startups listed on the site, despite there being over 2,500 investors listed as interested in investing in Perth startups.

Conclusion

So what does the degree of connectedness of a startup indicate? Not much, maybe. But at the very least it provides a proxy for the number of touch points between a company and the ecosystem, as well as an interesting perspective through which to analyse the ecosystem itself.

It also provides us with a watch list of companies to keep an eye on going forward. Will these connected companies perform better on average than other companies which fly under the radar? Or are we dealing with the limelight-seeking moths of the startup world, who simply attend every event and apply for every program and award available?

As the Techboard scoring system matures and we improve its ability to independently assess a company’s longer term performance, we will hopefully be in a position to better answer this question.

The insights to be gained are valuable with respect to the companies, but also to the hubs themselves and their respective contribution to the ecosystem.

Errors and omissions

In the interest of optimising space and maintaining legibility of the map, judgement calls were required as to which companies and hubs were to be included. For instance, two potential hubs which didn’t quite make the final cut (but arguably could have been included) were the WAITTA INCITE awards and the state government’s Innovation Vouchers program.

We apologise to anyone who feels slighted by an omission, and encourage any feedback to ensure future iterations of this map are appropriately corrected where necessary.

Acknowledgements

We are in particular grateful to Kate Raynes-Goldie, Sheryl Frame, Greg Riebe, Zeta Welch, Danelle Cross, Sam Mead, John Clema, Simon Handford and Jeff Broun for their time and contributions.

Notes

The FTI (Film and Television Institute WA) funds Playup Perth, WA Screen Awards, OOMPF and Level One, and is essentially the hub for the games industry in Perth.

The WA Department of Commerce funds the Innovator of the Year program and the Innovation Centre of WA.

Accelerating Commercialisation is delivered by the federal government’s AusIndustry division.

Sync Labs is managed by Spacecubed as part of their joint venture together.

Fusion Founders takes place at co-working space Tech Hub, and both are run by Atomic Sky.