Welcome to the February 2022 edition of FUNDED our eight edition to date. Techboard has been reserving its in depth analysis to our reports. All of the funding events we capture go into our funding event search engine that enables filtering by nine variables. Find out more about subscribing to our data here.

February is the first $1b+ month so far for 2022, with over $1.1b in private investment for the month and included two new Unicorns... more below. The most funded sector by far was again Fintech, led by Australian/European BNPL, Scalapay, A$692 million in a debt and equity.

January FUNDED revisited

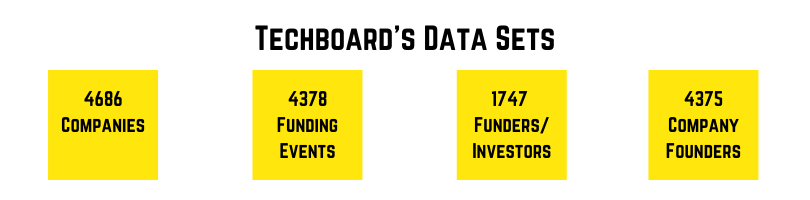

In our January edition of FUNDED we reported the biggest January to date by a factor of more than four.with over $600m in VC/private investments (or over $1b if you count an investment into Cyara's $490m round)...see below. After further research and review we identified a total of 71 funding events including 28 private investments, which raised a total of $692m. Those funding events have been added to the Techboard database, along with new company, investor and founder profiles, bringing Techboard’s tallies to the end of January to 4378 funding events, 4686 Companies, 1747 funders and investors and 4375 company founders.

Find out more about FUNDED. While the list below is lengthy it is far from the complete list of what we capture. For access to our full data capture, sorted, catalogued and full searchable, inquire about a data subscription.

NEW to FUNDED… Deal Notes

For the second time FUNDED features deal notes from a selection of Australian Investors, this time we have Ten13, Tidal, Oneventures, Squarepeg and Afterwork Ventures. Links to these and other deal notes will be added to the growing Techboard platform.

Ten13: Instant Pre-Seed Investment Notes

Squarepeg and Afterwork: OwnHome $31m Series A and Doubling Down: OwnHome's $31 million Series A, led by Square Peg and Commbank

OneVentures: Investment Notes: Kepler Analytics

TidalVC: Investment Notes: Blakthumb

Contact us if you would like your firm’s deal notes included.

For insights from CY2021 check out Techboard's latest Funding Bulletin

So what happened in February 2022?

Who’s been FUNDED?

The month’s megadeals (>$50m)

Scalapay becomes a unicorn with a $1.9b valuation for its series B raise.

Employment Hero becomes a unicorn with a $181m raise.

Karbon raises $93m led by Tidemark Capital

Acquisitions

Online pet medication and healthcare products business Pet Chemist has been acquired by Mad Paws for $25m.

Online fitness business The Healthy Mummy has been acquired by Halo Food Co for $17m.

MYOB acquires Nimbus Portal Solutions for an undisclosed sum.

Beauty and wellbeing marketplace Bookwell is set to be acquired by Fresha.

Employment Hero uses some of its raised funds to acquire KeyPay.

IPOs

My Rewards lists on the ASX.

Other Funding Events (VC/Private, Public(ASX), ECF, Debt, Grants/Awards)

(This is just a sample of the deals we captured in February - Commercial Subscribers get the full list + full searchable access to all funding data captured by Techboard since 30 July 2017).

Workforce management startup Lifelenz closes a $45m series B raise.

Digital ID verification start-up OCR Labs closes a $42m series B raise.

Autonomous mapping and data analytics startup Emesent closes a $32m series A raise led by Perennial Value Management.

OwnHome closes a $31m private round.

Carbar closes a $28.9m raise led by IAG and Seven West Media.

MoneyMe secures $25m of debt funding from Pacific Equity Partners instead of its planned capital raise.

Brick and mortar customer analytics tech startup Kelper Analytics receives $22m in funding from OneVentures, whom they were previously rejected by in 2020.

Plant-based protein startup Change Foods closes a $21.5m seed raise.

Perth based fintech PictureWealth closes a $14m series A raise.

Lumi Finance closes a $10m raise.

Medtech Next Science completes a $10m placement.

Climate tech startup FloodMapp closes a record $8.4m seed raise.

Cancer cell therapy company Chimeric Therapeutics completes a $7.37m Institutional Entitlement Offer.

Customer experience company Upflowy closes a $6.6m raise.

Mad Paws raises $5.6m via placement to help fund its acquisition of Pet Chemist.

Cannabis products group Creso Pharma closes a $5m placement.

One-click payment startup Instant closes a $2.2m pre-seed raise.

Proptech startup PropHero closes a $1.6m seed raise.

Women’s shopping app Her Black Book closes a $1.6m raise led by CEO of Andrew Forest’s Tattarang and Minderoo Foundation, Andrew Hagger.

Artesian backed Remi AI closes a $1.44m seed round.

24 Aussie startups awarded the latest Advanced Manufacturing Growth Centre-managed Commercialisation Fund grant.

SaaS startup Blakthumb closes an $825k pre-seed raise led by Tidal Ventures.

Natural Food Emporium receives $400k Boosting Female Founders Grant.

Annie Brox of Origio.farm receives $399k Boosting Female Founders Grant.

Advertising marketplace startup Helio receives investment from Scalare Partners.

Woolworths invests in All G Foods for a second time.

Other funding events for our paid subscribers: Our paid subscribers get access to the full list containing another 36 funding events.

News from Funders

AirTree raises $700m for 3 funds.

Main Sequence Ventures receives $150m from Australian Government's $2b research commercialisation plan.

Tiger Global raises US$11b for their PIP 15 fund.

Farmers2Founders receives one of three $600k Victorian AgTech Entrepreneurs Initiative grants from LaunchVic to run their Hatch Ideas Pre-Accelerator for agtech startups in Victoria.

SproutX receives one of three $600k Victorian AgTech Entrepreneurs Initiative grants from LaunchVic to run their Business of Agriculture program for agtech startups in Victoria.

Rocket Seeder receives one of three $600k Victorian AgTech Entrepreneurs Initiative grants from LaunchVic to run their AgTech Seeds Pre-Accelerator Program for agtech startups in Victoria.

The South Australian Government announces $1.5m for the Venture Catalyst Space program.

For Blue awarded the X-TEND WA Grant.

Spacecubed Ventures awarded the X-TEND WA Grant to fund Female founder development through a digital technology incubator program.

St Catherine’s College awarded the X-TEND WA Grant to fund an accelerator for youth entrepreneurship.

IPS Foundation awarded the X-TEND WA Grant to fund a pre-accelerator program for First Nation entrepreneurs from across Western Australia.

King River Capital raises $50m of a desired $150m to a new fund dedicated to Web3 investments.

Ocean Impact launches an accelerator with $2.5m to invest in participants.

Aera VC raises $42m for a new climate fund.

Insurance company IAG closes a $75m second fund dedicated to startups.

Cleantech startups will soon be able to seek investment from newly created Virescent Ventures.

King River Capital raises $50m of a desired $150m to a new fund dedicated to Web3 investments.

V-Ignite raising $120m from LaunchVic and other investors for Victorian startups.

Who’s Looking for Funding?

Gut health growth firm Microba is seeking a $30m IPO.

Volt Bank is seeking a $200m series F raise.

iBuildNew is seeking a $10m raise.

BrickFit is seeking a $3m raise.

Nut allergy biotech Prota Therapeutics is seeking $20m to fund its next phase of trials.

Proptech startup PointData is seeking $11m to fund its next leg of expansion.

Tic:Toc is close to completing a series D raise.

Crypto investor Tiik closes is planning for a series A raise.

Online fashion retailer Peppermayo is seeking a strategic investor.

Kimberley founded online clothing group Ringers Western is seeking a pre-IPO raise.

Renewables company Genex Power raising $10m SPP, closing on March 17.

Mad Paws launches an SPP to raise up to a further $1.5m, applications close on March 25.

Chimeric Therapeutics commences a $10.5m Retail Entitlement Offer, closing on March 11.

Xpansiv Data Systems is seeking to float on the ASX.

Medtech Next Science opens a $5m SPP, closing on March 18.

Zip Co seeks a $200m post-listing raise.