Startup & Tech Company Funding report for March Quarter Out NOW!!

This is the second funding report we have published, and the first covering the eastern states, so it is an exciting milestone for Techboard. The Report only includes deals announced or confirmed in the January to March 2017 quarter, involving startups and tech companies which are eligible for a listing on Techboard. The scope is currently limited to New South Wales, Victoria, Western Australia and the Northern Territory. In line with Techboard’s plans to take its Startup Ranking fully National, we will also be expanding the coverage of future funding reports to include the remaining Australian states.

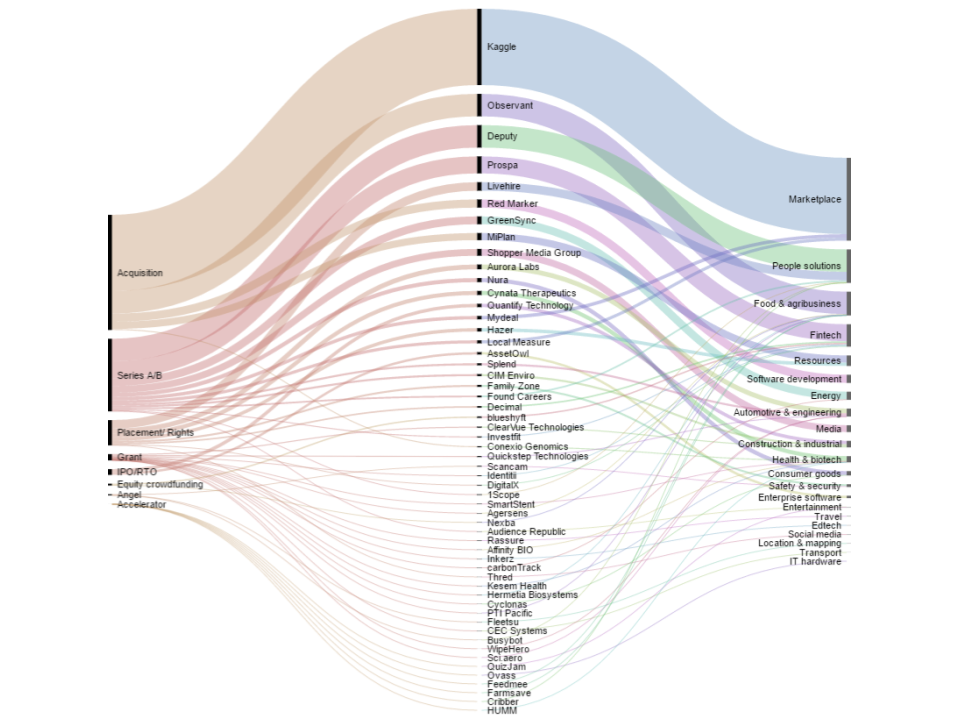

The first quarter of 2017 saw over $160m of funding going into startups and tech companies in NSW, Victoria and WA. In addition, an estimated $170m’s worth of acquisitions took place.

An average of over four deals per week were recorded, with the bulk of the funding coming through Series A or B rounds ($106m across 13 separate rounds, mostly in NSW) and acquisitions (estimated at $170m).

Four acquisitions and a business sale were recorded, all of which were US initiated. The highest profile acquisition was US-based but Melbourne-founded Kaggle, with the data science marketplace snapped up by Google in March. Also in March Florida-headquartered global education group Kaplan acquired Sydney-based regtech Red Marker. While the terms of the acquisitions were not disclosed, estimates of the likely valuations put the total of the five deals at over $170m.

Western Australia saw two ASX listing via reverse takeovers, with Quantify Technology (smart buildings) raising $5m and AssetOwl (asset management) another $3.5m.

In addition, 16 government grants were recorded, mainly from two federal programs:

- The Cooperative Research Centre Project (investing $1.6m into ClearVue Technologies’ collaboration with ECU, and $1.3m into Quickstep Technologies);

- Another $6m was pumped into a dozen startups across NSW and Victoria through the Accelerating Commercialisation program (this is the confirmed amount where funding agreements have been signed, not just offers made).

Only three angel investments were recorded this quarter (Scancam, Fleetsu and Busybot), all in WA, though this likely greatly underestimates the true volume of typically private deals.

The quarter also saw two crowd-funded companies raise a combined $2.6m, on VentureCrowd (Nexba at a valuation of $20m) and CapitalPitch (blueshyft at a valuation of $12.5m).

This infographic illustrates the comparative scale of the different types of funding and acquisition events (click to enlarge).

Techboard’s Chief Data Nerd Rafael Kimberley-Bowen said:

“As part of the regular startup ranking that Techboard has been compiling for close to two years now, we have collected a comprehensive set of data on Australian startups and tech companies, including funding rounds, strategic partnerships, press coverage, and other such milestones. We also track a variety of metrics on all companies listed on Techboard including web and social media stats. We are slowly making these publicly available on the companies’ profile pages.

“This is the second funding report we have published, and the first covering the eastern states, so it is an exciting milestone for Techboard. As well as painstakingly compiling publicly available information, we rely on investors collaborating with us by updating us on deals they are involved in. This is why we offer investors and other stakeholders a complimentary subscription to our Funding Reports in exchange for their updates.”