Techboard is pleased to present its latest report "Australian Startup Funding in Review 2024", our latest report reviewing announced deal data collected by Techboard during 2024.

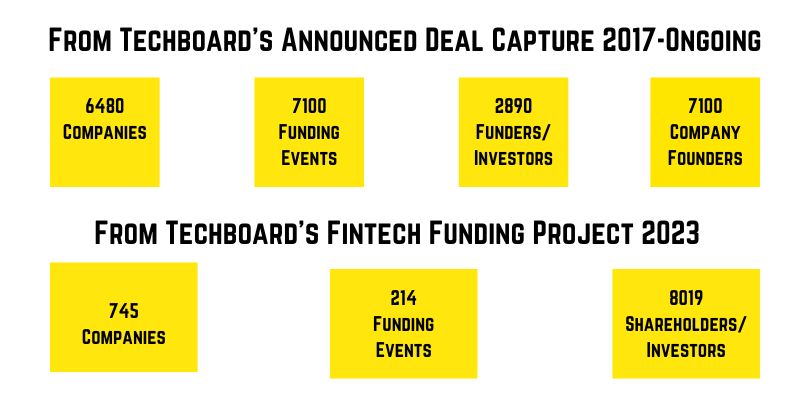

Over 2024 Techboard has been focusing on the addition of ASIC-sourced data to our data capture, which was highlighted in our last publication “The Fintech Funding Project 2023 Report: Shedding Light on Investment into Australian Fintechs” published in August last year. In that work we compare the results of analysis of ASIC sourced data with our industry leading announced deal data capture to reveal insights that are not possible to derive from examining only announced deals. The approach also sheds a great deal of light on who is investing, revealing investors that are lower profile than those routinely appearing in company announcements and press coverage of deals.

This report is focused on announced Private/VC investments into Australian Startup and Tech companies, from early stage to scaleup/growth companies.

In 2024 Techboard uncovered $4.106 billion in private investment from 477 private announced investments. This level of investment was 7% lower than the $4.44b captured in 2023 and significantly lower than that captured by Techboard in the previous two calendar years, making 2024 the fourth highest on record 29% ahead of the level in 2020 before the spike in funding seen in 2021.

2024 only saw two quarters where >$1b in investment was announced (down from 3 in 2023), namely June ($1.59b) and December ($999.5 m, rounded to $1b). The June Quarter was the largest quarter since before the funding boom in 2021 and larger than any quarter on record before then.

In the report we analysed the year’s data against a number of key variables. What we found was quite enlightening.

Deal Label

- Valuations are up from 2023 levels;

- Investment totals per deal stage are up from series A to E; and

- Deal volumes from seed stage to series D are down.

Deal Sizes

- Deal sizes below $20m saw a drop in number of deals across all size bands from 2023 levels. $20-$50m deals were up 12% and $100m+ deals were up 50%;

- Total dollars invested in all but two size bands declined from 2023 levels with only the $10m-$20m and $100m+ showing increases.

- Even though overall investment levels for 2024 were down, Megadeals ($50m+) were up from 2023 levels, jumping from 18 to 21 and accounted for more than half (51%) of total investment overall and in each Supercategory Deeptech, Climatetech and SuperFintech.

Categories

- Deeptech saw a total of $2.02b for the year, just under 50% of all announced private investment

- The Supercategory Fintech saw just shy of $1b of investments announced.

- Climatetech Companies announced $785m of investment

- Healthtech Companies announced $473m of private investment.

Through a Gender Filter

- Solely women founded companies saw a slight increase in their share of overall funding securing 4.17% of overall funding from 11.1% of deals continuing the improvement from the lows of 2021.

- Companies with at least one woman founder saw a reasonable drop in total investment from 2023 levels.

- We identified a marked drop in the $10-$20m size band for solely women-founded companies with the number of deals in this band sitting at between 2 and 3 per year between 2020 and 2023, dropping to 1 in 2024. This drop is significantly more than experienced by all-male founding teams.

- In good news for women-founded companies, Techboard saw an increase over time in the $5-10m band from 1 deal each in 2020 and 2021, jumping to 5 in 2022 with 4 in 2024, This was positive news compared to the general drop in deals experienced by all male teams.

Funding by State

- Four states experienced increases in total announced investments and three saw drops in announced investments since 2023.

- New South Wales had the largest share of investment announced in 2024 with $2.5b invested, but suffered a 12% drop in total investments since 2023.

- Victoria’s share of investment increased by 20% to $931m.

- South Australia’s announced investments grew by 80%.

- Announced deals in Queensland startup and tech companies has continued its decline from 2021, with a 48% drop in the last year and an overall drop of 79%, greater than any other state other than Tasmania with an 86% drop since 2021.

The online report is published on Canva and contains many interactive charts using the Flourish platform which was acquired by Canva. While the report can be viewed on mobile, the best viewing experience will be on a larger screen.

You can also download the Review in PDF form without the interactive charts below:

Techboard's Datasets

For access to our full data capture, sorted, catalogued and full searchable, inquire about a data subscription.

Details of all deals we capture are available on the Techboard platform for our paying subscribers. Inquire about a data subscription.