This is the second Month that Techboard has issued a Funding Bulletin giving a monthly breakdown and analysis of Australian Startup and Young Tech company funding. Until our first such bulletin last month we had been compiling and releasing our data on a quarterly basis since 2017. Back in April 2020 in order to enable us to deliver our insights to the Ecosystem and data to our data customers more rapidly and to track how the pandemic is impacting upon startup and tech funding almost as it happens we decided to move to monthly data collection and reporting.

Techboard is soon going to be compiling its funding data for June 2020 and undertaking a detailed analysis for our Annual report for the 2019/20 financial year which will contain much more detailed analysis of funding over the year, with Sectoral, State, funding type, dealsize and investor breakdowns and more. We are also soon going to be making some exciting announcements about improved access to Techboard Funding and Investor Data.

The funding and investor data underlying this Bulletin is now available to Techboard's Commercial Subscribers.

General Overview

Techboard compiled 82 funding events for Australian Startup and young tech companies during the month of May, netting a reported $523m (including 29 funding events of unreported size) coming from 60 identified funders. This overall funding level placed May slightly behind the monthly average during the FY19 of $535m. For the month Techboard added 42 companies and 28 investors/funders to its growing database which now contains over 3500 companies and over 750 investor/funders.

Private Investment

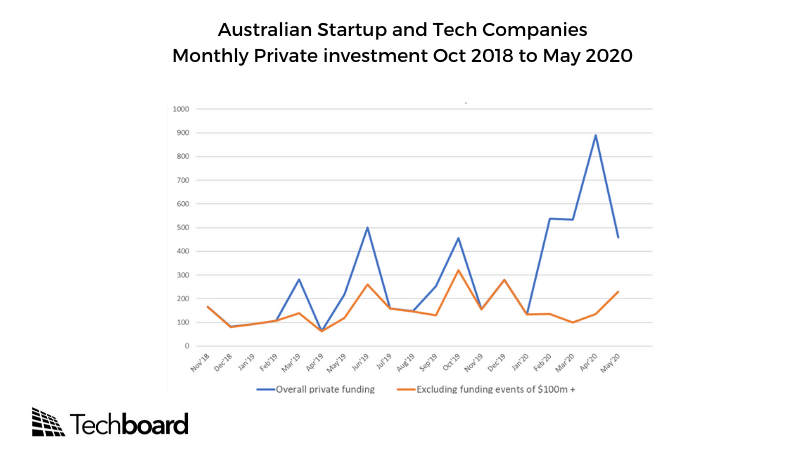

We recorded $459m of private investment which accounted for 88% of total funding for the month. Private funding levels were sitting roughly at the monthly average during the 2019 calendar year but down from the levels recorded in the previous three months (which averaged at $653m) and behind the trend that was emerging up until the end of the 2019 calendar year. We have however seen a partial recovery of sub $100m private investments (see Fig 1).

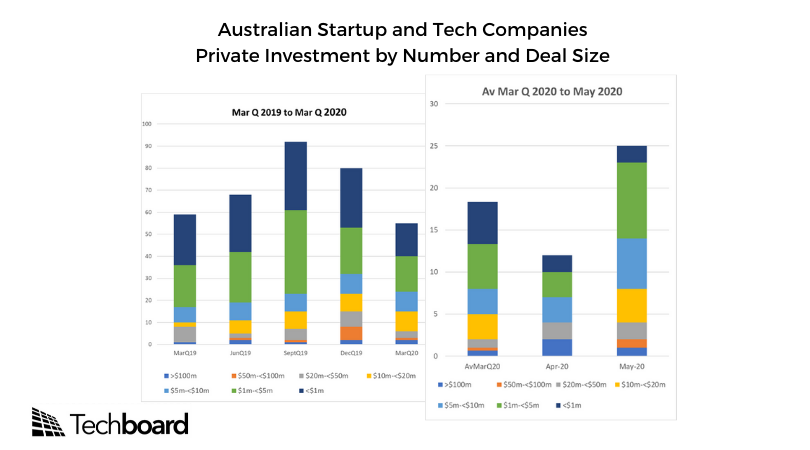

Breaking down the investments further by size we noticed improvements across all deal size ranges other than $20-$50m and $100m. (see Fig.2). The improvement in the numbers of investment deals from the first four quarters is welcome but it looks like we are seeing a general softening of the market, which is unfortunately to be expected in the circumstances.

Public Investment

Many companies on the ASX took advantage of revised ASX rules to raise large rounds to boost their coffers for the anticipated tougher months ahead or to pursue new opportunities positively impacted by the COVID crisis. This trend did not seem to impact the funding of junior (sub 10yr old) tech companies, with only one eligible IPO, for Healthtech IOT startup Intelicare (ASX:ICR) which raised $5.5m for its independent living environment smart AI technology.

Techboard’s analysis revealed no significant (>$10m) post listing raises for young tech companies with the largest being $7.5m for Quickfee (ASX:QFE) with only $28.7 raised via post listing raises. One NZ based fintech, Smartpay raised $13m (but is excluded from Techboards data capture).

Category Analysis

The month was not as dominated by Fintech as usual. Judo Bank had the largest raise but of the top 10 funding events captured, only three of the top ten funding events were fintechs, with Judo Bank, Xinja and OpenMarkets.

Regions

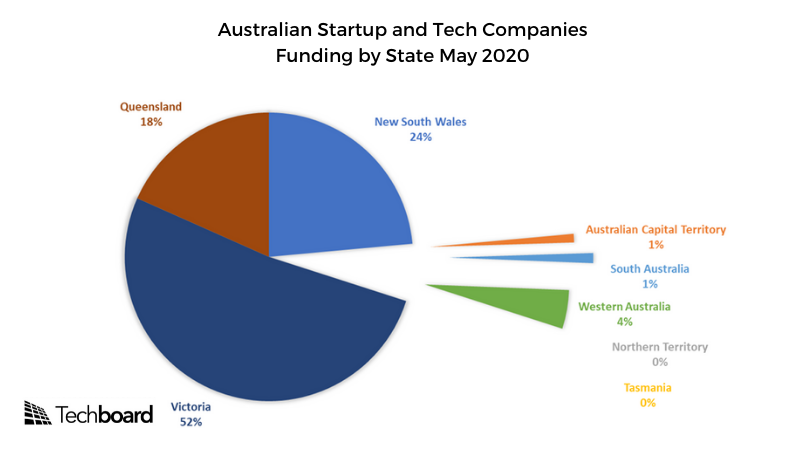

The funding for the month was as usual heavily biased towards the larger states of New South Wales (24%) and Victoria (52%) but Queensland companies took their largest percentage of funding for many periods receiving 18% of all funding on the back of the massive raise by EdTech GO1, vaccine maker Vaxxas, fintech funding.com.au and Oventus Medical being the major recipients.

Investor Analysis

The most prolific investor for the month (post Accelerator) was Artesian who were involved in twelve reported Australian deals (several of these were during April but reported in May) although most of those investments were for an undisclosed amount. Antler was the most active Accelerator investor for the month accepting 13 into its latest cohort with investments of $100K each.